A Deep Dive into Lakmé Cosmetics: Navigating the Market and Understanding its Share Price

Related Articles: A Deep Dive into Lakmé Cosmetics: Navigating the Market and Understanding its Share Price

Introduction

With great pleasure, we will explore the intriguing topic related to A Deep Dive into Lakmé Cosmetics: Navigating the Market and Understanding its Share Price. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A Deep Dive into Lakmé Cosmetics: Navigating the Market and Understanding its Share Price

Lakmé, a household name synonymous with Indian beauty and cosmetics, has carved a significant niche in the global market. Its journey from humble beginnings to a leading player in the beauty industry is a testament to its adaptability, innovation, and strong brand recognition. Understanding the dynamics of Lakmé’s share price is crucial for investors looking to capitalize on the potential of this beauty giant.

Tracing Lakmé’s History: From Humble Beginnings to Market Dominance

Lakmé’s story begins in 1952, when J.R.D. Tata, inspired by the French opera "Lakmé," envisioned a cosmetics brand that would cater to the specific needs of Indian women. The brand’s initial focus was on providing high-quality, affordable products, a strategy that resonated with the Indian market.

Over the decades, Lakmé has evolved from a local player to a global brand. It has consistently innovated, introducing new products and adapting to changing consumer preferences. The brand’s commitment to research and development, coupled with its understanding of the Indian market, has played a pivotal role in its success.

Factors Influencing Lakmé’s Share Price

Lakmé’s share price is influenced by a complex interplay of factors, including:

- Financial Performance: Profitability, revenue growth, and overall financial health are key indicators for investors. Strong financial performance typically translates into higher share prices.

- Industry Trends: The beauty and cosmetics industry is dynamic, constantly evolving with new trends and consumer preferences. Lakmé’s ability to adapt and capitalize on these trends significantly impacts its share price.

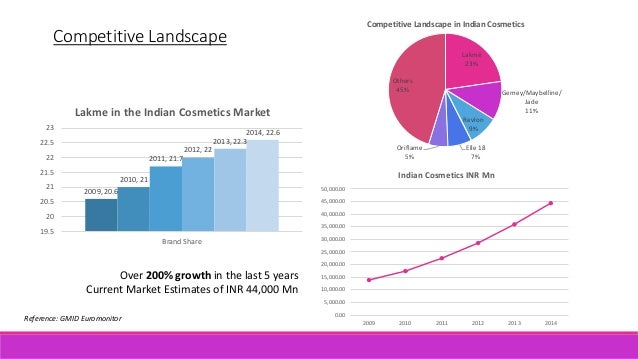

- Competitive Landscape: The Indian cosmetics market is highly competitive, with both domestic and international players vying for market share. Lakmé’s competitive advantage, brand image, and product innovation influence its share price.

- Economic Conditions: Macroeconomic factors such as inflation, interest rates, and consumer spending patterns can influence consumer behavior and, in turn, impact the demand for cosmetics products, affecting Lakmé’s share price.

- Regulatory Environment: Government policies and regulations, including those related to product safety and marketing, can impact the cosmetics industry and influence Lakmé’s share price.

Analyzing Lakmé’s Share Price Performance

While specific historical data on Lakmé’s share price is not readily available due to its ownership structure within the Hindustan Unilever Limited (HUL) conglomerate, analyzing HUL’s performance can provide insights into Lakmé’s market position.

HUL’s share price has generally shown positive growth over the years, indicating the strength and stability of the company. This growth is largely attributed to the success of its various brands, including Lakmé.

Understanding the Importance of Lakmé’s Share Price

Lakmé’s share price is a crucial indicator of the company’s financial health and market value. For investors, it reflects the potential return on investment. For the company itself, a strong share price boosts its credibility and attracts further investment, enabling it to expand its operations and introduce new products.

FAQs about Lakmé Cosmetics Share Price

1. Is Lakmé a publicly traded company?

Lakmé is not a publicly traded company. It is a subsidiary of Hindustan Unilever Limited (HUL), which is a publicly listed company.

2. How can I invest in Lakmé?

You can invest in Lakmé indirectly by investing in HUL shares. HUL’s share price reflects the performance of all its brands, including Lakmé.

3. What factors should I consider before investing in HUL shares?

Before investing in HUL shares, consider the factors mentioned earlier, such as financial performance, industry trends, competitive landscape, economic conditions, and regulatory environment. Conduct thorough research and consult with financial advisors before making any investment decisions.

4. How does Lakmé’s share price affect its future growth?

A strong share price can attract more investment, enabling Lakmé to expand its operations, introduce new products, and enhance its market position.

Tips for Investors Interested in Lakmé

- Stay informed: Monitor industry trends, economic conditions, and Lakmé’s financial performance to make informed investment decisions.

- Diversify your portfolio: Don’t solely rely on Lakmé or HUL shares. Diversify your investment portfolio across different sectors and asset classes to mitigate risk.

- Consult with financial advisors: Seek professional advice from experienced financial advisors who can guide you through the investment process and help you make informed decisions.

Conclusion

Lakmé’s share price, though not directly available for independent trading, is a reflection of its overall performance within the HUL conglomerate. Understanding the factors influencing HUL’s share price provides valuable insights into Lakmé’s market position and potential for growth. Investors interested in the beauty and cosmetics sector should closely monitor the performance of HUL and its brands to make informed investment decisions.

Closure

Thus, we hope this article has provided valuable insights into A Deep Dive into Lakmé Cosmetics: Navigating the Market and Understanding its Share Price. We appreciate your attention to our article. See you in our next article!